Metro Melbourne’s residential land market is showing clear signs of recovery, with renewed buyer confidence and improving borrowing conditions helping drive the strongest sales activity seen in two years.

A key indicator of consumer sentiment—the Westpac–Melbourne Institute Index—rose slightly to 92.6 in June 2025, buoyed by a recent RBA rate cut and moderating inflation. This uplift in confidence has translated into higher land sales, with volumes increasing from just under 700 lots in April to over 800 in both May and June. On average, monthly sales have risen by 172 lots compared to the same time last year—marking the highest levels since mid-2022.

“We’re seeing tangible signs of momentum returning to Melbourne’s land market,” said Red23 Managing Director Terry Portelli.

“Land sales are lifting steadily across key growth corridors, supported by greater affordability and consumer confidence. Sales volumes are now at their strongest in two years, with regional areas like Greater Geelong also showing signs of recovery. These are early but important indicators that the market is stabilising after a period of subdued demand.”

Among Melbourne’s growth municipalities, Wyndham and Casey led the charge in May and June 2025, accounting for 27% of total sales each. Both regions continue to benefit from a larger number of active projects and greater land availability. Whittlesea followed with 13% of sales—driven by ongoing strength in Wollert— while Hume and Melton recorded 12% and 11% of sales respectively. Mitchell Shire, particularly Beveridge, contributed 4%.

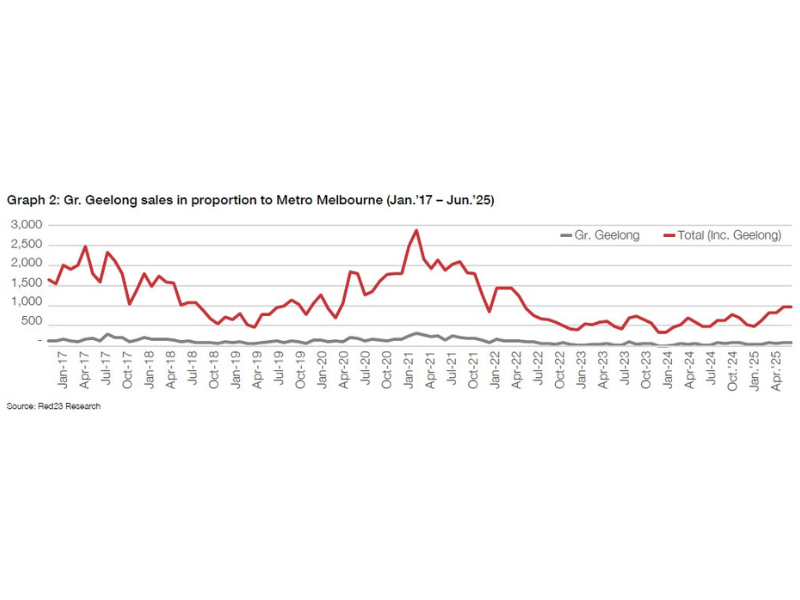

Regional markets are also beginning to bounce back. In Greater Geelong, land sales have risen to their highest monthly total in over two years, with approximately 400 sales recorded year-to-date. That equates to an average of 65 lots per month—well above the subdued volumes seen during 2023. Geelong now accounts for approximately 8% of total market activity, suggesting the recovery is spreading beyond metropolitan areas.

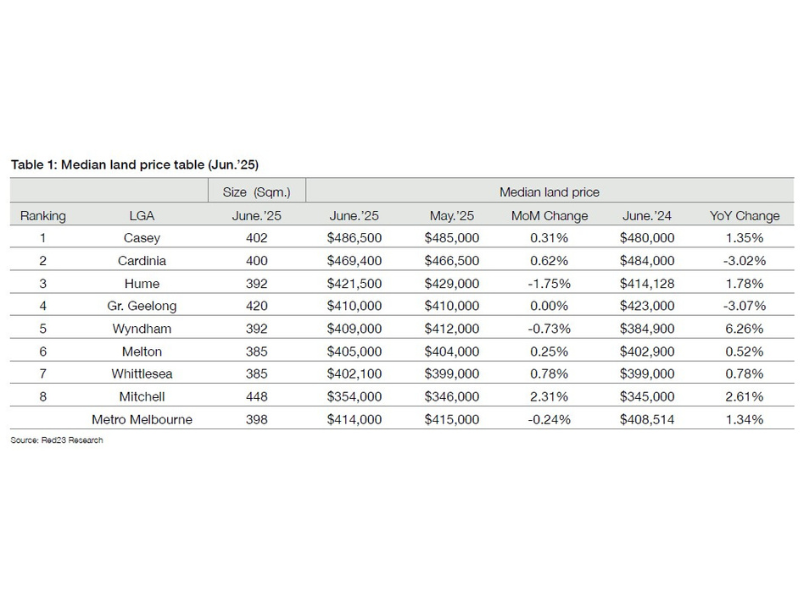

Median land prices across Melbourne’s growth areas remained largely steady in June. Mitchell recorded the strongest monthly price growth at +2.3%, bringing its median to $354,000. Modest gains were also observed in Whittlesea (+0.8%), Cardinia (+0.6%), Melton (+0.3%) and Casey (+0.3%). Wyndham remained flat, while Greater Geelong held at $410,000.

On an annual basis, Wyndham recorded the highest growth in land prices, rising by 6.3%—driven by a 25sqm increase in median block size. Moderate yearly growth was also seen in Mitchell (+1.8%) and Hume (+2.6%), while Cardinia and Greater Geelong recorded small declines of approximately 3%.

Lot sizes across the market continue to hover around the 400sqm mark. However, slight reductions in median block sizes were noted in Casey (-13sqm), Hume (-8sqm), and Melton (-1sqm). Mitchell still offers the most generous average at 448sqm, despite a notable drop from 497sqm the previous month.

Overall, the slight $1,000 decrease in Melbourne’s median land price in June was consistent with a modest 2sqm reduction in average land size. Importantly, volumes remain up, and the shift in buyer sentiment is helping to re establish stability across the broader land market.

Publisher Website: www.homeshelf.com.au