A rare 3.37-hectare greenfield site in Rochedale has sold to CFMG Capital for $11,000,000, in a deal reflecting surging demand for development-ready land in Brisbane’s booming southern corridor.

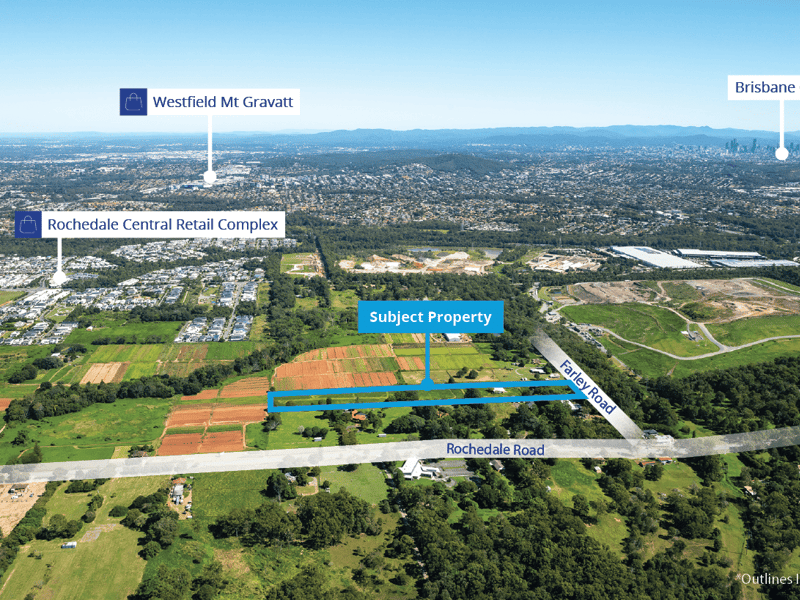

The strategic landholding at 32 Farley Road, Rochedale, transacted by Colliers experts Brendan Hogan, Adam Rubie and Kristian Brymora, attracted over 100 enquiries and received eight formal offers, underscoring significant investor and developer appetite for rare, developable land in Brisbane.

The purchaser has submitted a development application for a 27-lot boutique residential project, which is still subject to Council approval.

Colliers Queensland Residential Director Brendan Hogan said the site was located just 14 kilometres from the Brisbane CBD and within the Rochedale Urban Community Neighbourhood Plan, offering a strategic infill opportunity in a rapidly tightening land market.

“The successful sale of this site demonstrates the ongoing demand for premium development sites in Brisbane’s southern growth corridor, fuelled by continued population growth and limited future supply,” Brendan Hogan said.

“The volume of enquiries and competitive bids reflects just how tightly held premium development sites are becoming, particularly those offering some certainty through existing approvals,” Brendan Hogan added.

Colliers Queensland Residential Director Adam Rubie said Rochedale remained a key target for both local and interstate developers, with median house prices hitting $1.83 million, which is 47 per cent higher than the broader Brisbane area.

“Brisbane is now recognised as having the best growth prospects of any capital city, this is supported by massive public and private investment in infrastructure and major projects,” Adam Rubie said.

“This site will assist in filling the gap of the significant demand for vacant residential land located close to the CBD. We’re seeing a clear flight to quality—buyers are prioritising zoned, well-located land where the fundamentals support strong retail values.

“The acquisition comes as Brisbane continues to attract sustained interest from institutional and private capital, buoyed by robust population growth, historically low residential vacancy rates, and infrastructure investment ahead of the Brisbane 2032 Olympic Games,” Adam Rubie added.

Colliers Queensland Residential Executive Kristian Brymora said with 1.31 hectares earmarked for residential and an additional 1.6 hectares designated for district sports use, the site presents a dual-faceted opportunity to capitalise on both strong residential demand and increasing local amenity needs.

"This transaction reaffirms the strength of Brisbane’s market, particularly in well-established greenfield pockets like Rochedale, where supply constraints continue to support land values,” Kristian Brymora said.

Publisher Website: www.homeshelf.com.au